San Diego Home Insurance - Questions

San Diego Home Insurance - Questions

Blog Article

Safeguard Your Home and Liked Ones With Affordable Home Insurance Coverage Program

Value of Affordable Home Insurance Policy

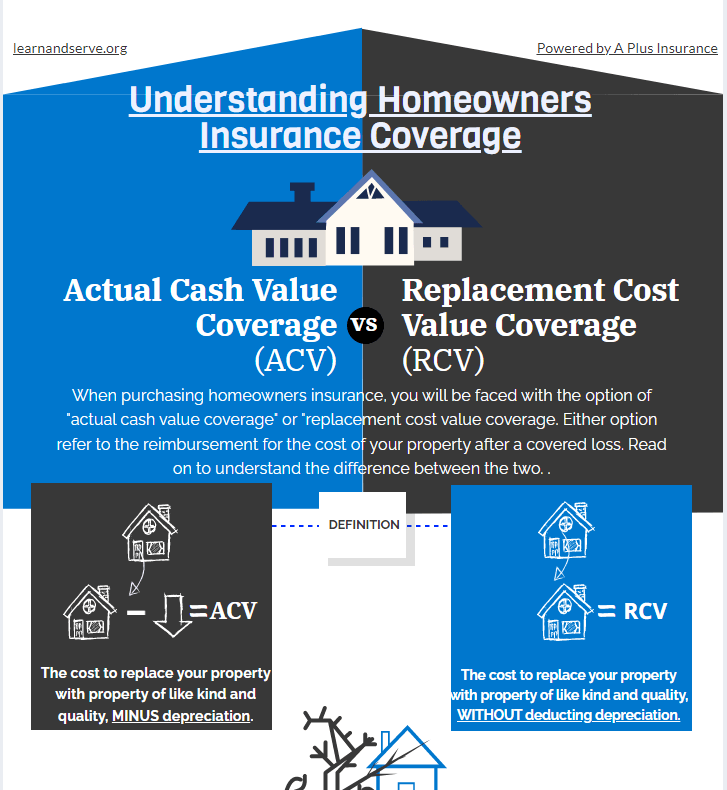

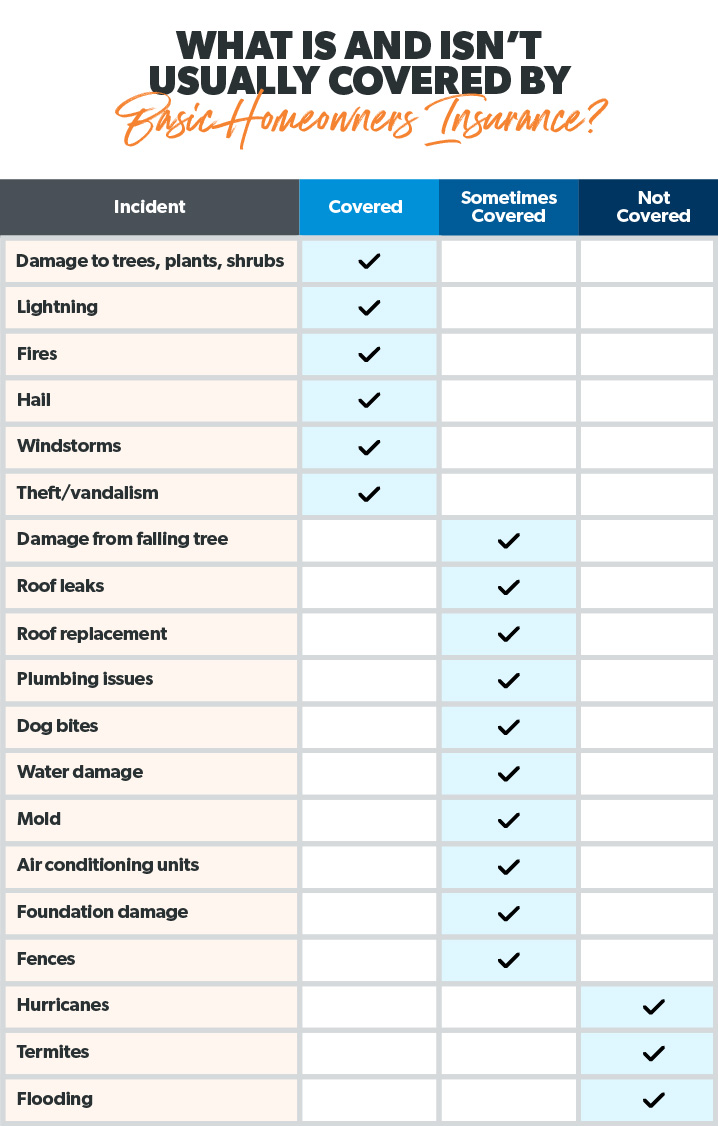

Securing cost effective home insurance is essential for safeguarding one's property and economic wellness. Home insurance policy supplies protection versus different risks such as fire, burglary, natural disasters, and individual obligation. By having an extensive insurance policy plan in place, homeowners can feel confident that their most significant financial investment is protected in case of unforeseen situations.

Budget friendly home insurance policy not only gives monetary security but also provides satisfaction (San Diego Home Insurance). Despite climbing property worths and building and construction expenses, having an affordable insurance coverage ensures that home owners can easily restore or repair their homes without dealing with substantial financial worries

Furthermore, affordable home insurance coverage can also cover personal items within the home, offering compensation for things damaged or taken. This coverage prolongs beyond the physical framework of your house, shielding the contents that make a residence a home.

Protection Options and Limits

When it concerns protection restrictions, it's critical to comprehend the optimum amount your plan will certainly pay out for every kind of coverage. These limitations can differ relying on the plan and insurance firm, so it's important to assess them thoroughly to ensure you have ample protection for your home and assets. By understanding the protection choices and restrictions of your home insurance coverage, you can make educated choices to secure your home and loved ones successfully.

Factors Affecting Insurance Policy Prices

A number of variables considerably influence the expenses of home insurance policy plans. The place of your home plays a vital function in figuring out the insurance coverage costs.

In addition, the kind of coverage you pick straight impacts the expense of your insurance plan. Choosing extra coverage choices such as flood insurance coverage or quake protection will certainly boost your costs. Likewise, selecting greater coverage limitations will certainly result in greater costs. Your insurance deductible amount can additionally impact your insurance expenses. A greater insurance deductible typically suggests lower premiums, yet you will need to pay more expense in the event of an insurance claim.

In addition, your credit scores rating, asserts history, and the insurance coverage business you select can all affect the cost of your home insurance plan. By thinking about these aspects, you can make educated decisions to assist manage your insurance sets you back efficiently.

Comparing Providers and quotes

Along with contrasting quotes, it is crucial to assess the credibility and monetary stability of the insurance coverage providers. Look for customer reviews, rankings from independent agencies, and any kind of background of complaints or regulatory actions. A trustworthy insurance policy company need to have a great track document of immediately processing insurance claims and offering outstanding customer solution.

Additionally, consider the details protection features supplied by each carrier. Some insurance firms may use fringe benefits such as identity theft protection, devices breakdown coverage, or protection for high-value items. By carefully contrasting carriers and quotes, you can make an informed decision and select the home insurance coverage plan that finest meets your requirements.

Tips for Saving Money On Home Insurance Coverage

After thoroughly comparing suppliers and quotes to find the most ideal protection Get the facts for your needs and spending plan, it is prudent to discover efficient approaches for conserving on home insurance. Lots of insurance firms provide discounts if you buy multiple policies from them, such as incorporating your home and automobile insurance. Consistently examining and updating your policy to mirror any modifications in your home or circumstances can ensure you are not paying for insurance coverage you no visit homepage longer need, assisting you conserve money on your home insurance coverage costs.

Conclusion

In conclusion, guarding your home and enjoyed ones with economical home insurance coverage is vital. Carrying out ideas for saving on home insurance can also aid you safeguard the needed security for your home without breaking the financial institution.

By untangling the details of home insurance coverage plans and exploring sensible methods for protecting economical coverage, you can make certain that your home and liked ones are well-protected.

Home insurance plans normally provide several protection options to shield your home and items - San Diego Home Insurance. By recognizing the coverage alternatives and limitations of your home insurance plan, you can make informed choices to protect your home and enjoyed ones efficiently

Routinely assessing and updating your plan to reflect any kind of modifications in your home or conditions can ensure you are not paying for insurance coverage you no longer requirement, aiding you save cash on your home insurance costs.

In verdict, protecting your home and enjoyed ones with affordable home insurance coverage is crucial.

Report this page